The idea behind Social Security is remarkably simple. People aren’t disciplined enough to save and invest their money responsibly. Hence, the Social Security program automatically deducts 12.4% of your income from every paycheck (half directly from you, and the other half from your employer). And once you retire, you receive a pension roughly proportional to the amount of money you had put into the program.

Contrary to what many may think, Social Security isn’t a tax used to fund other government programs. The money contributed to Social Security is used strictly for retirees’ Social Security benefits, not to build highways or fund our military. Regarding income redistribution – this is a more complex topic, but the National Bureau of Economic Research has concluded that Social Security does not actually redistribute any money. You get out of Social Security what you put into it. Regardless, the headline conclusion holds true for middle-class and lower-middle-class workers, as shown below.

Conceptually, Social Security seems pretty similar in many ways to 401(k). You put money into the program. And you get money back in your retirement, proportional to the amount you put into it. There are two major differences between Social Security and 401(k) however.

The first is that 401(k) is completely voluntary. You can choose to save a tiny amount, or even nothing at all. Social Security on the other hand, is mandatory. This one is obvious, and I would argue is something Social Security does better than 401(k).

Unfortunately for you and me, there is another difference that completely decimates the effectiveness of Social Security. With your 401(k) account, you can choose how you want to invest it. Bonds, domestic stocks, international stocks – you have the ability to invest your money and grow your nest egg. With Social Security however, you have no say at all in how your 12.4% paycheck contributions are invested.

Is this because the average person can’t be trusted to wisely manage their own investments? No, the true reason is far worse. The reason you don’t get to invest your money, is because most of your contributions aren’t capable of being invested. The vast majority of your contributions are being used to pay out Social Security benefits to those who are currently retired. Only a tiny surplus ends up getting invested in low-risk bonds. And even that is poised to change. For the last few years, Social Security has been running at a deficit. And it’s projected to continue running at a deficit for the foreseeable future. During which time, none of your contributions will be invested at all.

To put it simply, your savings today are being used to pay for someone else’s retirement. And once you retire, the program will use the savings from some other working stiff to pay for your retirement.

“Okay, that sounds weird, but is it really so bad? How does it matter as long as I get paid out?” Good question. Here’s why this really matters. If you’re being forced to save 12.4% of each paycheck, but those savings aren’t being invested into appropriate long-term investments, your retirement will be severely shortchanged. Imagine if you had put thousands of dollars into your 401(k) every single year, but didn’t invest that money at all. That’s basically what is happening with Social Security.

How much you could be getting

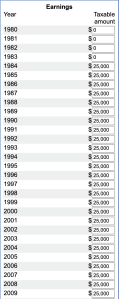

Don’t believe me? Let’s run some numbers. Let’s assume for simplicity that you:

- Started working at 22

- Worked for 40 years, and retired at 62

- Earned $25,000 each year

- Social Security collects 12.4% of this, which comes out to $3,100 each year.

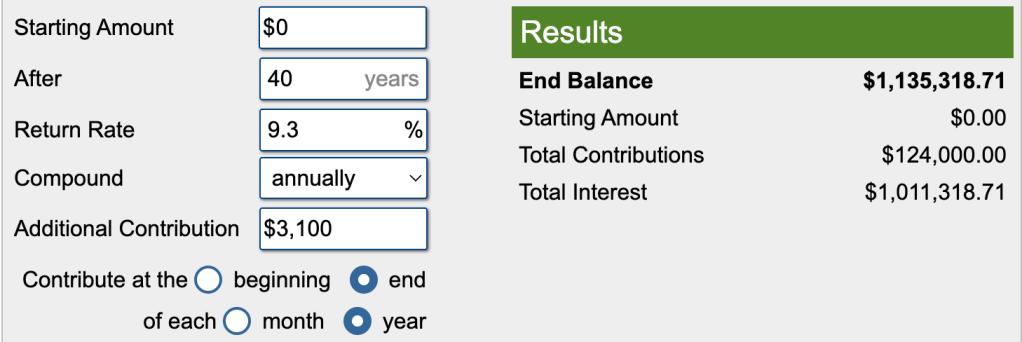

The gold-standard for a stable, reliable, long-term investment is the 60-40 portfolio, where you invest 60% of your assets into a diversified portfolio of stocks, and the other 40% into a diversified portfolio of bonds. Over the past 70 years, this portfolio has produced annual returns of ~9.3%.

Crunch the above numbers, and here’s what we get:

A whopping $1.1M nest egg at the age of 62. Not bad for someone earning $25,000 per year.

The standard recommendation is to withdraw 4% of your nest-egg each year (adjusting for inflation). Take 4% of the above, divide by 12 for a monthly amount, and here’s what we get: $3,784 every month, adjusted for inflation, for the rest of your life from the day you turn 62.

How much Social Security actually pays you

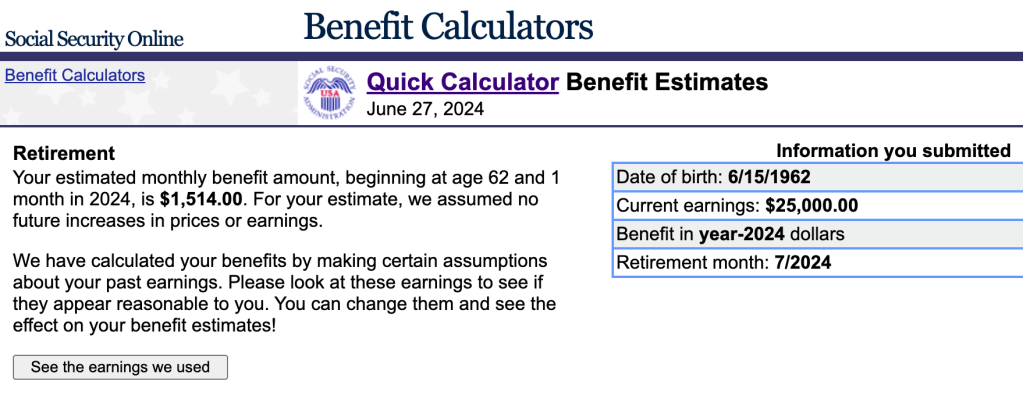

Okay, so the above is how much you could have been paid out if Social Security invested all your contributions in a 60-40 portfolio. But how much would you have been actually paid from today’s Social Security program?

The answer: A measly $1,514 each month. And even this is optimistically assuming that the projected 20% cut on Social Security benefits does not happen!

Crossing the Chasm

What a wild difference. If the Social Security program had simply invested every single worker’s contributions, our retirees today would be receiving Social Security checks that are twice as large. Someone scraping by with a $1500 monthly check, could instead be living a far better life with $3800 monthly checks. And this would be entirely their own money. No handouts or subsidies from anyone else. No new taxes required.

Sure, the above $3800 number depends on the exact returns they achieved over those 40 years. But even if we massively reduced the returns from 9.3% to 6.3%, you would still come out ahead. If investment risk is still a major concern, we could invest the contributions into annuities – an option that would reduce or even eliminate investment risk.

If only the Social Security program had been structured in this manner when it was first started, everyone today would be far better off. Unfortunately for us, making this switch today would be a monumental undertaking. Today’s retirees have already seen their contributions sent off to the previous generation that died decades ago. Hence, today’s retirees are entirely dependent on today’s workers’ contributions for their Social Security checks. If us workers want to invest our contributions instead, that would create a massive shortfall for today’s retirees.

Here are a couple options I can think of for solving this problem:

Option A: We rip the band-aid off and stop collecting any further contributions into the current Social Security program. Instead, all future contributions from today’s workers will be directed to a new program that is essentially like a mandatory 401(k). When we eventually retire a few decades from now, we will enjoy far more generous retirement benefits, almost twice as much as we would have otherwise received from Social Security. And best of all, our generous retirement benefits wouldn’t require any government funding whatsoever. They would be funded purely by our own savings and investments, just like our 401(k) accounts.

Unfortunately, without any further contributions into the existing Social Security program, the trust fund will be rapidly exhausted in the next two years. Today’s retirees will need to be paid by the government instead. In the following few years, this will require the federal government to spend over a trillion dollars each year to make today’s retirees whole. As time goes on, this trillion dollar figure will keep becoming smaller and smaller each year. Roughly 50 years from now, it will finally become a negligible expense, and we will be rid of the current dysfunctional system once and for all.

Option B: The above sounds wonderful but good luck trying to enact any policy that will cost the federal government a trillion dollars each year. Instead, we can try to achieve the same goal gradually over an entire century. Currently, 12.4% of each worker’s paycheck is sent to Social Security. We can reduce this number by a small amount each year. For example, next year we can send 12.2% of each worker’s paycheck to the existing Social Security program, and 0.2% to the new-and-improved retirement program.

If we reduce the contributions by 0.2% each year, we will finally halt all contributions to the existing program in the year 2086. Because we are reducing the contributions by a small amount each year, the existing program will still experience some deficits. We would still need the federal government to fund this deficit, but the annual cost would be far smaller since the deficit would also be smaller. Eventually, at some point in the early 22nd century, once the last worker from 2085 has died, we would finally be rid of the current Social Security program once and for all.

To be honest, I can’t envision either of the above options happening. Option A is too expensive in the short term – I doubt we can find the political will to stomach that. Meanwhile, option B requires waiting an entire century to see our desired goals come to fruition – the average voter simply does not have the attention span to think that far out. And that is why you and I will be stuck with monthly $1500 Social Security checks, when we could have been cashing $3800 checks instead.