Stoic philosophy is often assumed to have originated entirely in Greece, through philosophers such as Zeno. However, such a characterization ignores vastly similar Eastern philosophies such as those found in Buddhism or the Bhagavad Gita - a text that was authored in a similar time period, transmitted orally for centuries prior, and is one of … Continue reading The First Stoics – Philosophical Themes In The Bhagavad Gita

Life Lessons from Machine Learning

What comes to mind when you hear the term “Machine Learning”? A bunch of programmers hunched over their computers in a dark room, working on something completely virtual & divorced from reality? A group of scientists creating a Frankenstein monster that has no resemblance to us whatsoever? It may certainly seem that way, but you’d … Continue reading Life Lessons from Machine Learning

Reinventing Democracy – The Google Way

In the past, we had discussed the reasons why democracy is fundamentally flawed, needs to be overhauled, and what its replacement should look like. Admittedly, it was a highly abstract topic. Hence why we had also discussed a simple idea of how democracy could be reformed, to look more like the Jury system, as opposed … Continue reading Reinventing Democracy – The Google Way

Why Philosophy gets no Respect in Society

There was a time when philosophy was one of the most respected intellectual disciplines in humanity. Philosophical greats such as Aristotle, Plato and Kant are world renowned today, even centuries after their death. Others like Pythagoras and Newton considered themselves to be natural philosophers, and their contributions to mathematics have made them scientific idols even today. … Continue reading Why Philosophy gets no Respect in Society

The Deafening Silence Around Animal Cruelty

The past week has produced a number of interesting articles which have become instant talking points. There was one about the continuing lack of opportunities and hurdles facing women in the sciences. There was another about how rich people subconsciously empathize less towards people who aren’t as powerful as them. As can be expected, both … Continue reading The Deafening Silence Around Animal Cruelty

We Need Drastic Measures to Preserve Women’s Rights

The developed world is headed towards extinction. Just take a look at this table showing fertility rates across every developed nation. Of the 53 countries, only one has a fertility rate above replenishment. The average fertility rate is about 40% lower than what is needed simply for replenishment. Here in America, the average woman only … Continue reading We Need Drastic Measures to Preserve Women’s Rights

Election By Jury vs Citizen Assemblies

In past articles, we have explored Election By Jury (EBJ) - the idea that our political representatives (ie, mayors, governors, senators etc) should be elected by a jury in a courtroom-like setting (see here for more details). Anyone familiar with the sortition movement would notice that this idea has many parallels to a similar idea … Continue reading Election By Jury vs Citizen Assemblies

Who Pays the Tariff – How Voter Ignorance Impacts Public Policy

Who pays the tariff? To anyone who has been following the news in the past day, this question has suddenly taken on outsized importance. With the US Government firing the opening salvos in a global trade war, we have seen in just one day: The US stock market fall 5% International stock markets fall 2% … Continue reading Who Pays the Tariff – How Voter Ignorance Impacts Public Policy

Election By Jury – by H.G. Wells

For years, I labored under the illusion that I was the first to advocate for Election By Jury - at least in the modern era. Imagine my delight when I discovered that H.G. Wells had championed the same idea and made the exact same arguments an entire century before me. To anyone who (understandably) doesn't … Continue reading Election By Jury – by H.G. Wells

To Save Democracy, We Need to Rebuild Trust In Our Institutions

look, whatever the {official economic} charts say is a 100% bold faced lie. have you seen the price of a little ceasars pizza? it's jumped nearly 50% in the last 4 years. my salary has not gone up 50% relative to my experiece in the last 4 years. most recently i got a salary cut. … Continue reading To Save Democracy, We Need to Rebuild Trust In Our Institutions

2024 American Presidential Election – A Comedy of Errors

It’s hard to imagine a more incompetent group of people than literally everyone involved in the latest election season. Let’s go down the list. Donald Trump After losing a closely fought election in 2020, the smart thing to do would have been to concede gracefully and plot a comeback for the next election season. If … Continue reading 2024 American Presidential Election – A Comedy of Errors

The Best Way to Break Up Mega-Corporations: Progressive Taxes

Individual income taxes are very progressive: If you make $50,000/year, you pay 16% in taxes If you make $100,000/year, you pay 22% in taxes If you make $500,000/year, you pay 32% in taxes In contrast, business taxes are completely flat. The federal corporate income tax rate is a flat 21%. Which means that: A small … Continue reading The Best Way to Break Up Mega-Corporations: Progressive Taxes

8 Show – The Best TV Series You Haven’t Seen

3 years after the Squid Game, Netflix has a new Korean dystopian game-based TV show. It’s called “The 8 Show”. The directing is awful. The cinematography is laughably bad. The plot has more holes than swiss cheese. And yet, as a work of art, it has surpassed Squid Game. And no one knows about it. … Continue reading 8 Show – The Best TV Series You Haven’t Seen

Donald Trump – Both Victim and Perpetrator of Political Violence

Using violence to achieve political goals violates the very foundations of any democracy. We should all denounce political violence of all forms. This includes the assassination attempt on Trump in the past week. We have elections for a reason - no one should ever attempt to subvert the electoral process by assassinating a politician they … Continue reading Donald Trump – Both Victim and Perpetrator of Political Violence

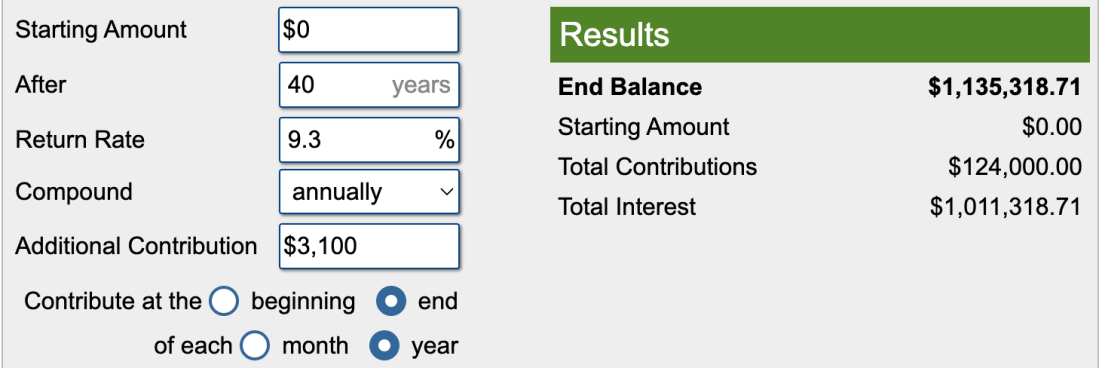

Social Security could have been paying us twice as much

The idea behind Social Security is remarkably simple. People aren’t disciplined enough to save and invest their money responsibly. Hence, the Social Security program automatically deducts 12.4% of your income from every paycheck (half directly from you, and the other half from your employer). And once you retire, you receive a pension roughly proportional to … Continue reading Social Security could have been paying us twice as much

Starve the Beast – How to get shit done in your life

Say what you will about the Republican party, but they sure know how to get what they want. Case in point: government spending. Everyone has something they would like to get from the government. Government workers want more pay. Soldiers want better veterans’ benefits. Retirees want enhanced social security and medicare. Youths want subsidized college … Continue reading Starve the Beast – How to get shit done in your life

Election by Jury – Ten Years On

Imagine if you were accused of murder, and facing life in prison. Who would you want deciding your fate? A jury of randomly selected citizens, who have spent weeks sitting in a moderated courtroom, listening to all evidence and testimony presented by both sides? Or a public referendum where every single person in your state … Continue reading Election by Jury – Ten Years On

I Shouldn’t Have The Right to Disrupt Your Life

There are protests, and then there are protests. Some protests are peaceful non-disruptive demonstrations. They gather large groups of people in places where they cause minimal disruption to the lives of non-protestors. If they manage to attract lots of people, and if their cause is morally appealing, they succeed in raising awareness and creating political … Continue reading I Shouldn’t Have The Right to Disrupt Your Life

The Israel-Palestine Debate Shows The Dangers of Groupthink

The philosopher Simone Weil posed a very insightful metaphor that I think is particularly apt today. To paraphrase greatly: Imagine if you were a mathematician trying to solve some very hard problems. If by chance you arrive at an odd number as an answer, everything is fine and life goes on as normal. But if … Continue reading The Israel-Palestine Debate Shows The Dangers of Groupthink

Proof that 4×4 is sometimes 10

TLDR: Base-16. Read on for a longer explanation if you haven't heard that term before. Yes, you read the title right. Under some specific circumstances and contexts, 4 times 4 is indeed 10. And this isn’t just abstract philosophizing or a gimmick - this is something engineers are directly working with and utilizing every day, … Continue reading Proof that 4×4 is sometimes 10

The End of Boredom

As an elder-millennial, I’ve seen boredom evolve dramatically over the course of my life. It has happened slowly, gradually, over many decades. So slowly that I never realized just how radically it has been transformed. And just how deeply troubling it really is. 1980 - 1990: The Age of Socializing As a kid growing up … Continue reading The End of Boredom

Beyond Affirmative Action – How To Avoid Stunting Entire Generations of Kids

Given recent news around Affirmative Action, it is understandable that it is all anyone can talk about. Regardless of your opinion on this topic however, what is not debatable is that countless millions of children in America are currently being shortchanged, and denied the childhood they need to succeed and pursue the American dream. Just … Continue reading Beyond Affirmative Action – How To Avoid Stunting Entire Generations of Kids

Past Returns Do Not Predict Future Performance – Not Even for Indexes

“Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.” We’ve all seen these disclaimers a million times before. Most people who are financially savvy nod along when they hear this, and think they have fully internalized this. But in truth, most haven’t. The majority of … Continue reading Past Returns Do Not Predict Future Performance – Not Even for Indexes

Nonqualified Dividends – You’re Probably Paying Too Much in Taxes

Disclaimer: This discussion centers around American tax law. If you aren’t American and don’t live in America, you may not get much value out of this. Real talk. I thought I knew a lot about personal finance. I thought I knew everything I practically needed to know to minimize my tax bill as an average … Continue reading Nonqualified Dividends – You’re Probably Paying Too Much in Taxes

How to Get Yourself Stuck in a Political Quagmire – Why Nothing Will Change after Tyre Nichols

If you haven't been living in a cave, you've likely heard recent news involving an innocent black man being brutally beaten to death by multiple police officers. As someone who supports greater oversight and accountability for police officers, let me make a prediction. Any bipartisan outrage that currently exists, will in time be replaced by … Continue reading How to Get Yourself Stuck in a Political Quagmire – Why Nothing Will Change after Tyre Nichols