Individual income taxes are very progressive: If you make $50,000/year, you pay 16% in taxes If you make $100,000/year, you pay 22% in taxes If you make $500,000/year, you pay 32% in taxes In contrast, business taxes are completely flat. The federal corporate income tax rate is a flat 21%. Which means that: A small … Continue reading The Best Way to Break Up Mega-Corporations: Progressive Taxes

Tag: Taxes

Social Security could have been paying us twice as much

The idea behind Social Security is remarkably simple. People aren’t disciplined enough to save and invest their money responsibly. Hence, the Social Security program automatically deducts 12.4% of your income from every paycheck (half directly from you, and the other half from your employer). And once you retire, you receive a pension roughly proportional to … Continue reading Social Security could have been paying us twice as much

Nonqualified Dividends – You’re Probably Paying Too Much in Taxes

Disclaimer: This discussion centers around American tax law. If you aren’t American and don’t live in America, you may not get much value out of this. Real talk. I thought I knew a lot about personal finance. I thought I knew everything I practically needed to know to minimize my tax bill as an average … Continue reading Nonqualified Dividends – You’re Probably Paying Too Much in Taxes

The ABCs of Personal Finance

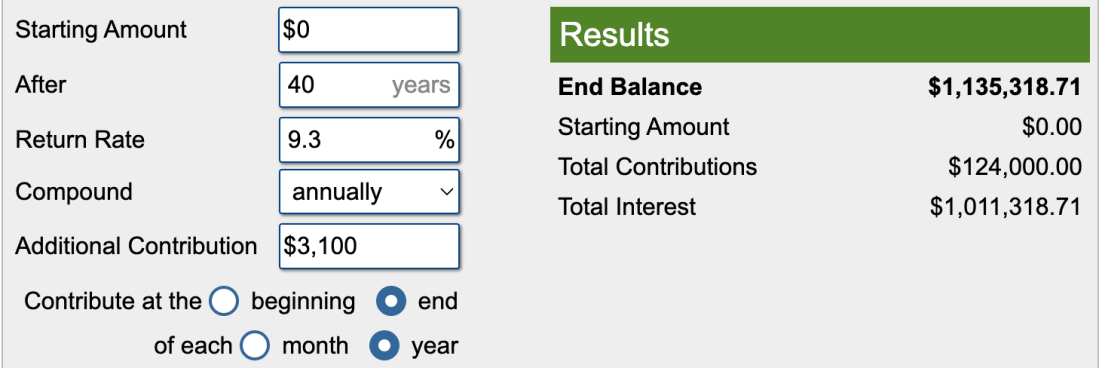

Do you want to be a millionaire? The odds may certainly seem to be stacked against you. Less than 0.2% of the world's population can claim to be millionaires. The average American household before the financial crisis in 2008 had a financial net worth of roughly $100,000. Today, the situation is even more dire, with … Continue reading The ABCs of Personal Finance