The idea behind Social Security is remarkably simple. People aren’t disciplined enough to save and invest their money responsibly. Hence, the Social Security program automatically deducts 12.4% of your income from every paycheck (half directly from you, and the other half from your employer). And once you retire, you receive a pension roughly proportional to … Continue reading Social Security could have been paying us twice as much

Tag: Personal Finance

Past Returns Do Not Predict Future Performance – Not Even for Indexes

“Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.” We’ve all seen these disclaimers a million times before. Most people who are financially savvy nod along when they hear this, and think they have fully internalized this. But in truth, most haven’t. The majority of … Continue reading Past Returns Do Not Predict Future Performance – Not Even for Indexes

Nonqualified Dividends – You’re Probably Paying Too Much in Taxes

Disclaimer: This discussion centers around American tax law. If you aren’t American and don’t live in America, you may not get much value out of this. Real talk. I thought I knew a lot about personal finance. I thought I knew everything I practically needed to know to minimize my tax bill as an average … Continue reading Nonqualified Dividends – You’re Probably Paying Too Much in Taxes

Aim to be Financially Independent

If you’ve done your research on Retirement Planning, you might have come across FIRE - Financial Independence Retire Early. Usually when people talk about FIRE, it’s an overnight switch that involves a massive lifestyle change. Quitting your job, pulling your kids out of their current school, moving your family to an entirely new low-cost-of-living region, … Continue reading Aim to be Financially Independent

Buy vs Rent – Ignore the Rent on the House You’re Looking To Buy and Live In

Buying a house is a huge financial decision that will impact your life for over a decade. It is far too important to be left to folksy catch-phrases. If you’re debating whether to buy a house or continue renting, you should definitely spend some time looking into buy-vs-rent calculators, of which there are many: NerdwalletNYTimesRealtor … Continue reading Buy vs Rent – Ignore the Rent on the House You’re Looking To Buy and Live In

People Used To Throw Their Money Away At The Grocery Store

Source Nov 19 2119, New York - There was a time when most people in the world were impoverished food renters. Ownership of food was concentrated in the hands of a tiny sliver of farmers and big corporations. Everyone else was at the mercy of this tiny sliver who wielded all the power. Until one … Continue reading People Used To Throw Their Money Away At The Grocery Store

Buy Low, Sell High: The Worst Financial Advice of All Time

As someone who’s given a number of talks on personal finance and managing your investments, there’s one piece of advice that I keep hearing from people over and over again. “Buy low, sell high”, they usually whisper to me in a sagely tone, as though they have discovered some profound truth that will unlock investment … Continue reading Buy Low, Sell High: The Worst Financial Advice of All Time

The ABCs of Personal Finance

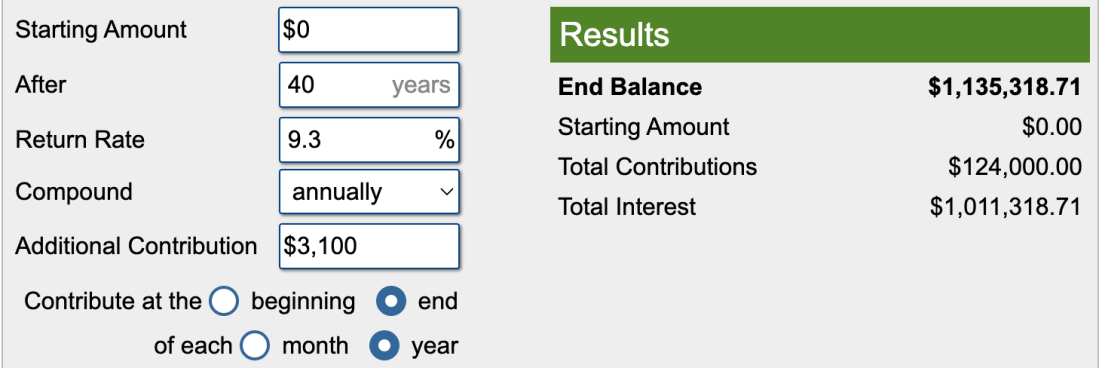

Do you want to be a millionaire? The odds may certainly seem to be stacked against you. Less than 0.2% of the world's population can claim to be millionaires. The average American household before the financial crisis in 2008 had a financial net worth of roughly $100,000. Today, the situation is even more dire, with … Continue reading The ABCs of Personal Finance